Monthly Payment Options for Mobile Devices: What to Consider

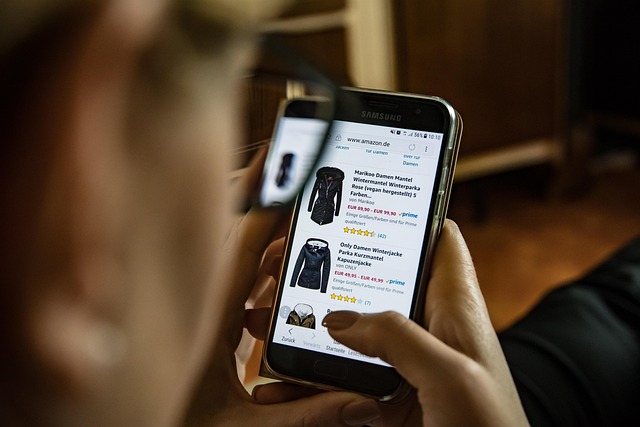

Acquiring a new smartphone has become more accessible through various financing methods that spread the cost over several months. Understanding the different payment structures available in the market helps consumers make informed decisions that align with their financial circumstances. From installment plans to device leasing and trade-in programs, each option presents unique advantages and considerations that warrant careful evaluation before commitment.

How To Finance Your Next Smartphone: Understanding Payment Plans and Leases

Smartphone financing has transformed how consumers access the latest mobile technology. Payment plans allow buyers to divide the full cost of a device into manageable monthly installments, typically ranging from 12 to 36 months. These arrangements often require an initial deposit, though some providers offer zero-down payment options for qualified customers.

Leasing arrangements present an alternative approach where users essentially rent the device for a predetermined period. At the end of the lease term, customers typically have three options: return the device and upgrade to a newer model, purchase the phone at its residual value, or extend the lease. Leasing generally involves lower monthly payments compared to traditional installment plans, making premium devices more accessible to budget-conscious consumers.

Carrier-based financing programs have become increasingly popular, integrating device payments directly into monthly service bills. These programs often include upgrade options after a certain percentage of the device cost has been paid. Independent financing through retailers or third-party financial institutions provides additional flexibility, sometimes offering promotional interest-free periods or rewards programs.

Important Factors To Consider Before Financing A New Mobile Phone

Before committing to any financing arrangement, assessing your financial stability is essential. Monthly device payments typically range from ₦5,000 to ₦25,000 depending on the phone model and payment term selected. These recurring costs must fit comfortably within your budget alongside other essential expenses and your mobile service plan.

Interest rates and fees significantly impact the total amount paid over time. While some promotional offers advertise zero-percent interest, standard financing arrangements may carry annual percentage rates between 10% and 30%. Early termination fees, late payment penalties, and administrative charges can add substantial costs if not carefully reviewed in the agreement terms.

Device insurance and protection plans represent additional considerations. Financing agreements often require or strongly recommend insurance coverage, adding ₦1,500 to ₦4,000 monthly to the total cost. Understanding what damages or losses are covered, deductible amounts, and claim procedures helps determine whether this additional expense provides genuine value.

Credit implications deserve attention, as financing arrangements may affect your credit profile. Some providers report payment history to credit bureaus, meaning consistent on-time payments can positively impact your credit standing, while missed payments may have adverse effects. Clarifying reporting practices before signing ensures you understand potential credit consequences.

Smart Shopping: Comparing Trade-In and Installment Plans For Phones

Trade-in programs offer an effective way to reduce the upfront cost of a new device by exchanging your current phone for credit toward the purchase. The value received depends on the make, model, condition, and age of your existing device. Phones in excellent condition typically command higher trade-in values, sometimes reaching 40% to 60% of their original retail price for recent models.

Comparing trade-in values across different providers reveals significant variation. Network carriers, independent retailers, and online platforms each assess device value differently. Obtaining quotes from multiple sources before committing ensures you receive fair market value. Some programs offer instant credit, while others require device inspection before finalizing the trade-in amount.

Installment plans without trade-ins require careful comparison of total cost, monthly payment amounts, and contract terms. The following table presents typical financing structures available in the market:

| Provider Type | Monthly Payment Range | Contract Duration | Key Features |

|---|---|---|---|

| Network Carriers | ₦8,000 - ₦22,000 | 12-24 months | Integrated billing, upgrade options |

| Retail Stores | ₦6,000 - ₦20,000 | 12-36 months | Flexible terms, promotional offers |

| Online Platforms | ₦7,000 - ₦18,000 | 6-24 months | Competitive rates, digital processing |

| Bank Financing | ₦10,000 - ₦25,000 | 12-24 months | Established credit relationship required |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Combining trade-in credits with installment financing can substantially reduce monthly payment obligations. For example, a device priced at ₦180,000 with a ₦50,000 trade-in credit reduces the financed amount to ₦130,000, lowering monthly payments across the chosen term. This strategy works particularly well when upgrading from a relatively recent model in good condition.

Evaluating Total Cost of Ownership

Beyond monthly device payments, understanding the complete financial picture requires accounting for all associated costs. Service plan expenses, which range from ₦2,000 for basic packages to ₦15,000 for premium unlimited plans, represent ongoing obligations throughout the device payment period. Accessories such as protective cases, screen protectors, and chargers add initial costs of ₦3,000 to ₦10,000.

Maintenance and repair expenses should factor into long-term planning. Screen replacements typically cost ₦15,000 to ₦40,000, while battery replacements range from ₦8,000 to ₦20,000 depending on the device model. These potential expenses highlight the importance of device protection and careful handling throughout the ownership period.

Calculating the total amount paid through financing compared to outright purchase reveals the true cost of convenience. A device with a retail price of ₦150,000 financed over 24 months at 15% annual interest results in total payments of approximately ₦173,000, representing ₦23,000 in interest charges. This comparison helps determine whether the flexibility of monthly payments justifies the additional cost.

Making an Informed Decision

Selecting the right payment option requires aligning financing terms with personal financial goals and circumstances. Short-term financing minimizes interest costs but involves higher monthly payments, while longer terms reduce monthly obligations at the expense of increased total interest paid. Assessing your financial stability over the contract period helps prevent payment difficulties that could result in penalties or device repossession.

Reading all contract terms thoroughly before signing protects against unexpected obligations. Pay particular attention to clauses regarding early termination, upgrade eligibility, device return conditions, and liability for loss or damage. Understanding these provisions ensures you can fulfill all agreement requirements and exercise available options when beneficial.

Timing your purchase strategically can yield significant savings. Retailers and carriers frequently offer promotional financing during holiday periods, product launch events, and end-of-quarter sales campaigns. These promotions may include reduced interest rates, waived fees, or enhanced trade-in values that improve the overall value proposition of financing arrangements.

Conclusion

Navigating mobile device financing requires careful consideration of multiple factors including payment structure, total cost, contract terms, and personal financial circumstances. Understanding the differences between installment plans, leasing options, and trade-in programs enables consumers to select arrangements that provide both immediate device access and long-term financial sustainability. Thorough research, comparison shopping, and careful review of all agreement terms position buyers to make confident decisions that align with their needs and budget constraints.