Monthly iPhone Payments: What You Need to Know

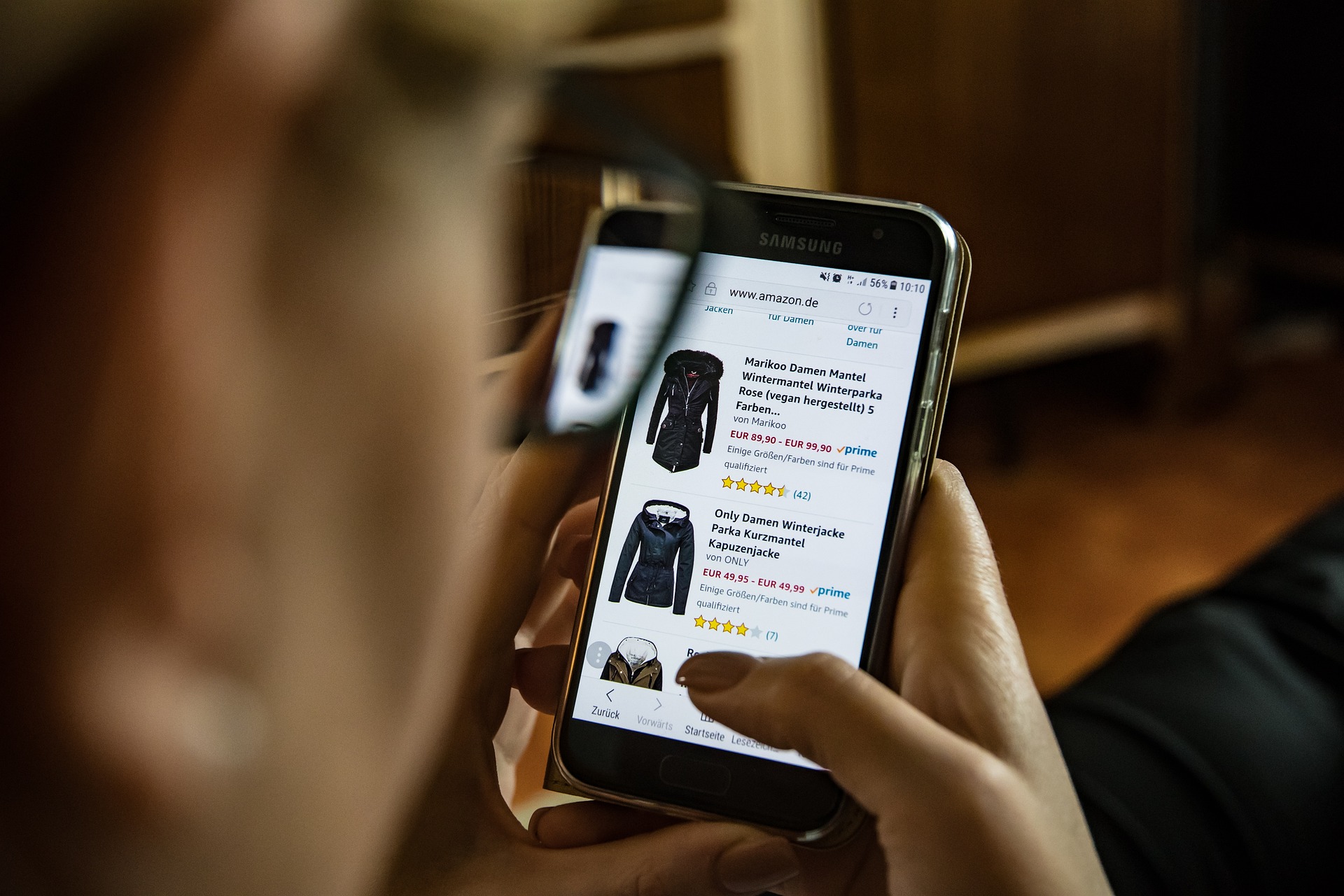

Understanding iPhone financing options has become increasingly important as smartphone prices continue to rise. With various payment plans available through carriers, Apple, and third-party retailers, consumers can access the latest technology without paying the full price upfront. These monthly payment programs offer flexibility but come with different terms, interest rates, and upgrade policies that significantly impact the total cost of ownership.

Smartphone financing has transformed how consumers purchase premium devices, making high-end technology accessible through manageable monthly payments. iPhone financing programs have evolved to offer various pathways to ownership, each with distinct advantages and considerations for budget-conscious buyers.

iPhone Financing Guide: Understanding Your Options

Apple and major carriers provide several financing solutions designed to spread iPhone costs over time. The iPhone Upgrade Program through Apple allows customers to pay monthly installments while including AppleCare+ coverage and annual upgrade eligibility. Carrier financing typically involves equipment installment plans that divide the phone’s cost over 24 to 36 months, often with zero percent interest for qualified buyers.

Third-party retailers and financial services also offer iPhone financing, sometimes with promotional periods featuring deferred interest or reduced rates. Credit requirements vary significantly between providers, with some offering options for customers with limited credit history through higher down payments or co-signer arrangements.

How to Own the Latest Model with Flexible Payments

Securing the newest iPhone through financing requires understanding eligibility requirements and comparing total costs across different programs. Most financing options require a credit check, steady income verification, and may involve trade-in evaluations for existing devices. The application process typically takes minutes for online applications, with instant approval decisions for qualified applicants.

Timing your purchase strategically can maximize value, particularly when new models launch and older versions receive price reductions. Many programs allow early payoff without penalties, providing flexibility for customers whose financial situations improve or who receive unexpected funds.

Comparing Monthly Payment Programs

Different financing providers offer varying terms that significantly impact the total cost and ownership experience. Carrier programs often bundle financing with service plans, potentially offering discounts for long-term customers or multiple lines. Apple’s program emphasizes upgrade flexibility and device protection, while third-party options may provide competitive rates for customers with excellent credit.

Contract length affects monthly payment amounts, with longer terms reducing monthly costs but potentially increasing total interest paid. Some programs include insurance or warranty coverage, while others require separate purchases for device protection.

Understanding Interest Rates and Fees

Interest rates on iPhone financing vary considerably based on credit scores, chosen providers, and promotional periods. Zero percent financing is common for qualified buyers during promotional periods, typically lasting 12 to 24 months. Standard rates for smartphone financing generally range from 0% to 29.99% APR, depending on creditworthiness and market conditions.

Additional fees may include activation charges, processing fees, or early termination penalties. Some programs waive these fees during promotional periods or for customers meeting specific criteria. Understanding the total cost of financing, including all fees and interest, helps consumers make informed decisions about their purchase timing and provider selection.

Real-World Pricing and Provider Comparison

Understanding actual costs across different financing options helps consumers make informed decisions about their iPhone purchase strategy.

| Provider | Device Model | Monthly Payment | Term Length | Total Cost |

|---|---|---|---|---|

| Apple iPhone Upgrade Program | iPhone 15 Pro | $54.12 | 24 months | $1,299 |

| Verizon Device Payment | iPhone 15 Pro | $55.55 | 36 months | $1,999.80 |

| AT&T Next | iPhone 15 Pro | $33.34 | 36 months | $1,200.24 |

| T-Mobile EIP | iPhone 15 Pro | $41.67 | 24 months | $1,000.08 |

| Best Buy | iPhone 15 Pro | $54.12 | 24 months | $1,299 |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Making Smart Financing Decisions

Successful iPhone financing requires evaluating personal financial situations alongside available options. Consider factors like existing carrier relationships, credit scores, desired upgrade frequency, and budget constraints when selecting a financing program. Reading all terms and conditions carefully prevents surprises regarding early termination fees, upgrade policies, or insurance requirements.

Calculating the total cost of ownership, including financing charges and required accessories or services, provides a complete picture of the investment. Some programs offer better value for customers planning to keep devices for extended periods, while others benefit frequent upgraders seeking the latest technology.

Choosing the right iPhone financing option depends on individual circumstances, credit profiles, and technology preferences. Comparing multiple providers, understanding all associated costs, and evaluating upgrade policies ensures consumers select programs that align with their financial goals and smartphone usage patterns.