Kenyan Consumers: Managing Split Bills Without Debt

Sharing expenses for rent, utilities, gadgets, or a night out is common in Kenya, but the way you split bills can make the difference between staying on budget and slipping into debt. This guide explains practical ways to manage shared costs, when instalment plans fit in, and how to protect your credit history.

Kenyan households and friends often pool resources for essentials, celebrations, and group purchases. Between mobile money convenience and fast retail checkout, it has become easy to split costs on the spot. Yet convenience can hide risk: if an instalment plan or credit-backed option is used for a shared expense, one person usually carries the legal responsibility. Understanding how these arrangements work—and setting clear rules—helps you avoid unnecessary debt.

Understanding the concept of Buy Now Pay Later plans

Buy Now, Pay Later (BNPL) plans let you take an item home and pay in scheduled instalments. Depending on the provider, you may pay a small upfront amount and then weekly or monthly instalments. Providers assess affordability using ID details and transaction history, and they may apply late fees if you miss payments. In Kenya, these plans are typically offered through partner retailers, device financing platforms, and fintechs that integrate with mobile money for repayments. Terms vary, so always read the contract, repayment schedule, and consequences of missed payments.

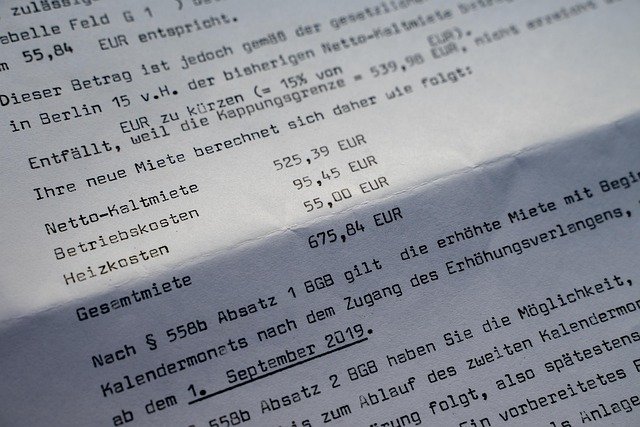

When you use instalments to split a group expense—say a fridge for a shared apartment—the account holder is the one tied to the contract. Even if friends promise to reimburse their shares, the provider will only pursue the named borrower if payments fall behind. To keep things fair, agree contributions in writing, confirm repayment dates, and avoid signing for more than you can cover alone if others default.

Exploring the pros and cons of Buy Now Pay Later services

BNPL can smooth cash flow for essentials, offer predictable instalments, and help you access large purchases without saving for months. It may also include added benefits such as device warranties or bundled services. For shared expenses, it can align payment timing with each person’s income cycle.

However, drawbacks include late fees, stricter terms after missed payments, and the temptation to overspend because the upfront cost looks small. Some device financing plans can restrict usage if you fall behind. For split bills, the biggest risk is concentration of liability: one person bears the full debt if others delay or stop paying. Consider non-debt options first—like saving up together, agreeing a short holding period before purchase, or using pay-now tools that track individual contributions—so the group avoids borrowing.

Insights into using Buy Now Pay Later and your credit score

Your credit history in Kenya is shaped by how you handle loans and other credit-like products. Some instalment providers perform checks and may report serious delinquency to credit reference bureaus (CRBs). Missed payments can harm your profile and make future borrowing (from banks, SACCOs, or overdraft facilities) more difficult. Timely payments may not always be reported as a positive, so BNPL is not guaranteed to build credit. Protect your file by borrowing only what you can repay from your own income, setting reminders, and avoiding multiple overlapping plans. If a shared purchase is involved, treat others’ contributions as helpful but never guaranteed.

| Provider Name | Services Offered | Key Features/Benefits |

|---|---|---|

| Lipa Later | Retail instalments for electronics, furniture, and other goods via partner stores | Digital approval process, scheduled monthly repayments, broad merchant network |

| Aspira (Cim Credit Kenya) | Point-of-sale financing for household items, electronics, travel, and services | Fixed repayment plans, documentation and affordability checks |

| M-KOPA | Pay-as-you-go financing for smartphones and solar home systems | Small frequent payments, device/system access contingent on payments |

| Safaricom Lipa Mdogo Mdogo | Smartphone financing for eligible customers | Daily or periodic repayments via mobile money, device access tied to payment status |

| FlexPay | Goal-based layaway to save and pay over time at partner merchants | No debt model; item is collected after full payment, helpful for planned group purchases |

Practical ways to split bills without taking on debt start with transparency and timing. Before committing, list the total cost, divide shares clearly, and agree a payment calendar that matches each person’s payday. Use mobile money requests to collect contributions upfront; only pay the merchant once everyone has sent their share. For recurring costs like utilities, rotate responsibility monthly but keep a shared ledger so that payments and dates are visible to all.

If a group must defer payment, a savings-first approach can reduce risk. A short-term pot—whether through a chama structure, SACCO sub-account, or a layaway plan—ensures no single person carries debt while money accumulates. For big-ticket items, agree a small buffer (for example, an extra 5–10% of the target price) to cover price changes or delays. Keep receipts and screenshots for every transfer to avoid disputes.

If you still consider BNPL for a shared item, set strict guardrails. The account holder should be someone with stable cash flow who is willing—and able—to pay in full if needed. Put repayment dates and amounts in writing (a simple signed note or shared document can suffice). Avoid overlapping instalment plans; keep total monthly obligations below a conservative share of your income so that essentials like rent, food, and transport remain fully covered. Confirm how missed payments are handled, whether devices can be locked, and any fees.

Mind your credit health while splitting bills. Use reminders or auto-pay for scheduled instalments, maintain a small emergency fund to absorb a late contribution from a friend, and review your overall commitments monthly. If a conflict arises, prioritise essential bills and communicate early; restructuring a plan is easier before arrears build up. Finally, test alternatives to debt—group saving challenges, layaway for travel or appliances, and negotiated discounts for cash payment—so that shared moments and shared purchases strengthen your finances rather than strain them.

In the end, the smartest way to manage split bills is to align convenience with caution. Clear agreements, upfront contributions, and thoughtful use of instalments where necessary help Kenyan consumers balance today’s needs with tomorrow’s financial stability.