Creative Financing Approaches for Mobile Phone Purchases

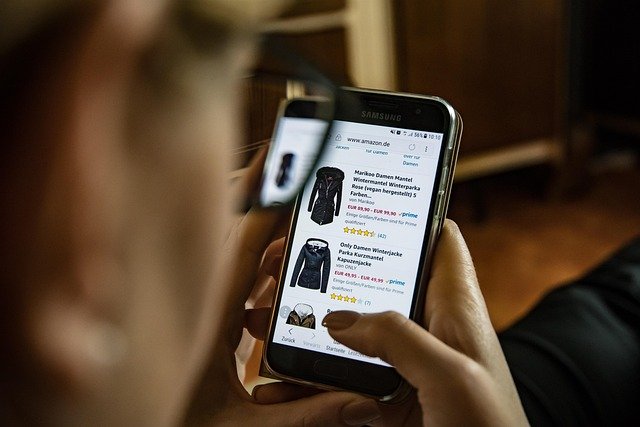

Mobile phones have become essential tools in modern life, yet their rising prices can strain budgets. For consumers in Singapore seeking flexible payment solutions, creative financing approaches offer practical alternatives to traditional upfront purchases. Understanding the various payment structures available can help you acquire the smartphone you need while managing cash flow effectively and maintaining financial stability throughout the purchase process.

Understanding Payment Flexibility for Smartphones

The smartphone market has evolved significantly, with devices now ranging from budget-friendly options to premium models costing over SGD 2,000. Traditional payment methods required full upfront payment, creating barriers for many consumers. Modern financing solutions have transformed this landscape, allowing buyers to spread costs over manageable periods. These arrangements typically involve partnering with financial service providers who facilitate deferred payment structures, enabling immediate device ownership while distributing financial obligations across weeks or months.

Singapore’s retail environment has embraced these flexible payment models, with major electronics retailers and telecommunications providers offering various plans. The regulatory framework established by the Monetary Authority of Singapore ensures consumer protection while allowing innovation in payment services. Understanding how these systems work helps consumers make informed decisions aligned with their financial circumstances.

How Deferred Payment Plans Operate

Deferred payment structures allow consumers to receive products immediately while postponing full payment. The process typically begins with a small initial payment or sometimes no upfront cost, followed by scheduled installments. Service providers conduct eligibility assessments based on factors like credit history, income verification, and existing financial commitments. Approval processes have become increasingly streamlined, often providing instant decisions through digital platforms.

These arrangements usually divide the total cost into equal installments over periods ranging from three to twelve months. Some providers offer interest-free periods, while others may include service fees or interest charges. Reading terms carefully ensures understanding of total costs, late payment penalties, and early settlement options. Responsible use of these services can provide convenient access to necessary technology without compromising financial health.

Smart Steps for Managing Installment Purchases

Successful management of installment-based smartphone purchases requires strategic planning and disciplined execution. First, assess your monthly budget to determine affordable payment amounts without straining essential expenses. Calculate the total cost including any fees or interest to understand the true price compared to upfront payment. Setting up automatic payments from your bank account helps avoid missed deadlines and associated penalties.

Monitoring your payment schedule through provider apps or websites keeps you informed of upcoming obligations and remaining balance. Consider the smartphone’s expected lifespan relative to the payment period—ideally, you should complete payments well before needing a replacement device. Avoid accumulating multiple deferred payment arrangements simultaneously, as this can create unsustainable financial pressure. Building a small emergency fund helps manage unexpected expenses without defaulting on installment commitments.

Creative Ways to Optimize Smartphone Financing

Beyond standard installment plans, several creative approaches can enhance affordability and value. Trade-in programs allow you to offset new device costs by exchanging older smartphones, reducing the financed amount. Timing purchases around promotional periods often yields better terms, such as extended interest-free periods or reduced service fees. Bundling smartphone purchases with telecommunications plans can provide integrated payment structures with potential savings on both device and service costs.

Some consumers successfully negotiate terms directly with retailers, particularly for higher-value purchases or when buying multiple devices. Employer benefit programs occasionally include technology purchase assistance or partnerships with specific retailers offering preferential terms. Student discounts and loyalty programs from telecommunications providers or electronics retailers can further reduce total costs. Exploring multiple providers before committing ensures you secure the most favorable arrangement for your circumstances.

Comparing Providers and Cost Structures in Singapore

Singapore’s market features several established providers offering flexible smartphone financing. Understanding the landscape helps identify options matching your needs and financial profile.

| Provider | Services Offered | Key Features |

|---|---|---|

| Atome | Installment payments for retail purchases | Interest-free periods, instant approval, wide merchant network |

| Grab PayLater | Deferred payment through Grab app | Integration with Grab ecosystem, flexible terms, digital-first approach |

| Pace | Point-of-sale financing | Quick approval process, multiple payment periods, retail partnerships |

| Hoolah | Split payment solutions | Three to twelve-month terms, transparent fee structure, online and in-store options |

| Major Telcos (Singtel, StarHub, M1) | Device bundled with plans | Integrated billing, contract-based pricing, device upgrade programs |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

When comparing providers, consider factors beyond just payment terms. Customer service quality, dispute resolution processes, and digital platform usability affect overall experience. Reading user reviews provides insights into real-world experiences with different providers. Verify that providers are licensed and regulated by appropriate Singaporean authorities to ensure consumer protection.

Avoiding Common Pitfalls in Smartphone Financing

While flexible payment options offer convenience, certain risks require awareness and mitigation. Overextending financially by committing to payments beyond comfortable budget limits can lead to defaults and credit score damage. Late payment fees accumulate quickly, significantly increasing total costs beyond the original device price. Some arrangements include clauses allowing providers to reclaim devices for non-payment, potentially leaving you without a phone and still obligated for remaining balance.

Carefully distinguish between interest-free promotions and arrangements with embedded costs. Marketing materials may emphasize low monthly payments while obscuring total costs or additional fees. Avoid using multiple deferred payment services simultaneously unless absolutely necessary and financially sustainable. Understanding your rights under Singaporean consumer protection regulations helps address disputes or unfair practices. Maintaining open communication with providers when facing financial difficulties often yields more favorable outcomes than simply missing payments.

Conclusion

Creative financing approaches have democratized access to smartphones in Singapore, enabling consumers to acquire necessary technology through manageable payment structures. Success with these arrangements depends on informed decision-making, realistic budget assessment, and disciplined payment management. By comparing providers, understanding terms thoroughly, and implementing smart financial practices, you can leverage flexible payment options effectively. These tools serve as valuable resources when used responsibly, balancing immediate technology needs with long-term financial wellness. The key lies in treating deferred payment arrangements as serious financial commitments requiring the same careful consideration as any other credit obligation.